Snapchat Stock [The Only Social Media Stock I’m Buying Right Now] https://youtu.be/DxTqf084K_o Stock analysis of the four biggest social media stocks and why I’m investing in Snapchat stock right now. This could be bigger than our 157% return on Pinterest stock but you have to buy this stock now. Check out the stock simulator and Get a FREE share of stock worth up to $1000 each when you open a Webull investing account with a $100 deposit! 🤑 https://ift.tt/2M1qRd4 Nobody believed me when I recommended Pinterest stock four months ago. It had just gotten smashed after the earnings and nobody wanted the shares. I saw a connection with Facebook stock and what happened to it just after the IPO…and bought $10,000 worth of shares. Pinterest is now up 157% and I think shares of Snapchat could do even better. In this video, I’ll show you how to invest in social media stocks. I’ll reveal the three measures I follow to analyze shares of Facebook and other social platforms. I’ll then do a detailed analysis of Facebook, Twitter, Pinterest and Snapchat. The first thing I look at analyzing social media stocks is Monthly Active User (MAU) growth, especially in the U.S. market where these social platforms make the most of their money. I then look at the Average Revenue per User (ARPU) to make sure that management is not only growing the user base but figuring out ways to make more money off each user. Finally, I’ll use my favorite metric the Enterprise Value-to-MAU ratio (EV/MAU) to find the best deal in social stocks. Facebook Stock Analysis Facebook is the clear leader among social platforms and is actually several platforms in one, including Instagram and WhatsApp. It has more than six-times the users than any other platform and is still growing by about 12% a year. The ARPU is the highest in this list but it’s not growing so that might be a problem. Despite the jump in shares, it’s also one of the cheapest social media stocks to buy right now. Twitter Stock Analysis Twitter never seemed to catch up to Facebook in users but is still growing at almost triple the pace. Twitter has had trouble making money off users but is the least expensive social media company for investors…though there may be a reason for it. Pinterest Stock Analysis We made an amazing return on the Pinterest stock recommendation but it’s getting a little expensive at this point. The ARPU is still very low so there’s room for improvement but it fell hard in the second quarter. On the upside, Pinterest has the highest MAU growth so might be able to grow into its valuation. Snapchat Stock Analysis Snapchat is the smallest social platform by users but I recently saw some data that blew my mind. The platform has an 80% penetration into the Gen Z demographic, as many as 47 million users, and more than Facebook and Instagram combined in that group. The company is also working on expanding its reach which could mean growth and surging revenue in the near future. 3:08 How to Invest in Social Media Stocks 5:56 Facebook Stock Analysis 7:26 Twitter Stock Analysis 8:32 Pinterest Stock Analysis 9:22 Snapchat Stock Analysis Join the conversation in our private Facebook Group! https://ift.tt/2SL3NCQ Join the Let's Talk Money community on Instagram! https://ift.tt/336QCQl My Investing Recommendations 📈 📊 Download this Portfolio Tracker and Investing Spreadsheet! [Community Discount Code] https://ift.tt/2IaUgA4 Free Webinar – Discover how to create a personal investing plan and beat your goals in less than an hour! I’m revealing the Goals-Based Investing Strategy I developed working private wealth management in this free webinar. Reserve your spot now! https://ift.tt/2TbmwcK My Books on Investing and Making Money 💰 📗 📈 Step-by-Step Dividend Investing http://amzn.to/2aLpFcs Step-by-Step Bond Investing http://amzn.to/2aLpA8p Make Money Blogging http://amzn.to/2kpL6Cr 📺 Crushing YouTube https://amzn.to/2YVCqfi 🙏 Step-by-Step Crowdfunding http://amzn.to/2aS2DRK SUBSCRIBE to create the financial future you deserve with videos on beating debt, making more money and making your money work for you. https://ift.tt/2zsdiOe Joseph Hogue, CFA spent nearly a decade as an investment analyst for institutional firms and banks. He now helps people understand their financial lives through debt payoff strategies, investing and ways to save more money. He has appeared on Bloomberg and on sites like CNBC and Morningstar. He holds the Chartered Financial Analyst (CFA) designation and is a veteran of the Marine Corps. Let's Talk Money! with Joseph Hogue, CFA

Subscribe to:

Post Comments (Atom)

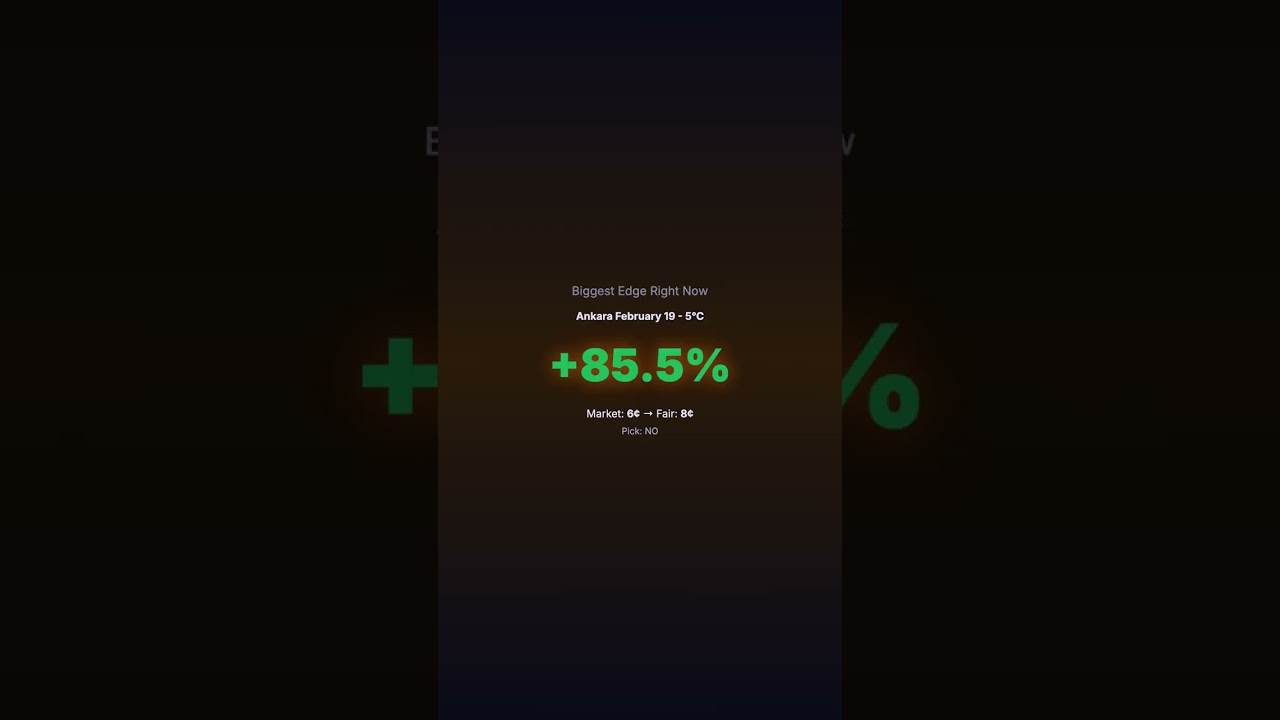

This Market Was 85% Off. Nobody Cared.

This Market Was 85% Off. Nobody Cared. https://www.youtube.com/watch?v=fnjIEYYCgVk A 85 percent edge. Sitting there for hours. Ankara Febru...

-

Top Dividend Stocks to Beat the Market [2x Stock Returns 2019] https://youtu.be/hPFm1sR7ihY These top dividend stocks are nearly doubling t...

-

**WTF Seriously, what is going on here ?? https://youtu.be/EMBJWXOgJhA Leave a Like if you enjoyed! For more financial planning info ➤ http...

-

Earn $200 in 10 Minutes for FREE (Work at Home) https://youtu.be/RCjySySVf0Y My #1 Recommendation to Earn Money Online CLICK HERE ➡️ https:...

No comments:

Post a Comment