3 Stock Market Bubbles Ready to Pop in 2020 https://youtu.be/Kcl_Ydx0uh4 These stock market bubbles and coming market crash will destroy your money. Are you ready? The stock market looks great. It’s up over 45% from the 2020 stock market crash and everyone is making money. What could go wrong? Unfortunately, anytime you pump $7 trillion-plus into the economy, there are going to be consequences. Market bubbles are going to form and those bubbles are going to pop, leaving a lot of investors broke. In this video, I’ll show you what is inflating those stock market bubbles. I’ll reveal the three market bubbles you need to be watching and what to do to protect your money. The coronavirus literally shut down the global economy with more than 40 million Americans filing for unemployment . In response, the government and central bank have forced more than $6 trillion dollars into the economy …to put that into perspective, it’s more than $18,000 pumped into the system for every man, woman and child in America. The Federal Reserve, the nation’s central bank , has pledged ‘unlimited financial asset purchases’ to support the market . The bank has lowered interest rates to zero and even started buying the bonds of junk-rated companies . The central bank, the agency tasked with guiding America’s monetary policy, is now buying the debt of companies that may not be able to pay it back. Was this extreme level of stimulus needed to keep the economy from falling into a depression? Absolutely! But that doesn’t mean there won’t be consequences and those consequences could destroy your investments if you’re not ready! Anytime you force that much money into the economy suddenly, it’s going to create bubbles. Even with tens of millions of people out of work, more than a hundred million-plus are still collecting a paycheck and most companies are still operating . The extra $600 weekly unemployment payment through the $2 trillion stimulus program means some are making more money on unemployment than they were before the crisis . With spending shut down, the personal savings rate surged to an all-time high of 32% in April, more than five-times its average . Americans are saving a third of their income and it has to go somewhere. That money is going into investments like stocks, bonds and real estate – pushing up the prices of these assets to record levels. The problem is, when the government turns off this artificial money machine, when it stops forcing trillions of dollars into the economy and these investments …prices could crash back into reality . The U.S. economy, when it functions normally, creates about $500 billion of wealth a year through wages and business growth. Imagine what could happen when instead of pumping $6 trillion into the economy, it’s only creating $500 billion …that means more than $5.5 trillion dollars is no longer propping up investment prices. Fortunately, there are ways you can protect your investments from these three stock market bubbles but you need to know what they are and how to prepare your portfolio. I can’t write out the entire thing so please watch the video. I’ll explain stock market bubbles and why it could lead to another market crash in 2020. I’ll reveal stock market bubble indicators and how to use them. Join the conversation in our private Facebook Group! https://ift.tt/2SL3NCQ Join the Let's Talk Money community on Instagram! https://ift.tt/336QCQl My Investing Recommendations 📈 📊 Download this Portfolio Tracker and Investing Spreadsheet! [Community Discount Code] https://ift.tt/2IaUgA4 Check out the stock simulator and Get 2 FREE shares of stock worth up to $1000 each when you open a Webull investing account with a $100 deposit! 🤑 https://ift.tt/2M1qRd4 Free Webinar – Discover how to create a personal investing plan and beat your goals in less than an hour! I’m revealing the Goals-Based Investing Strategy I developed working private wealth management in this free webinar. Reserve your spot now! https://ift.tt/2TbmwcK SUBSCRIBE to create the financial future you deserve with videos on beating debt, making more money and making your money work for you. https://ift.tt/2zsdiOe Joseph Hogue, CFA spent nearly a decade as an investment analyst for institutional firms and banks. He now helps people understand their financial lives through debt payoff strategies, investing and ways to save more money. He has appeared on Bloomberg and on sites like CNBC and Morningstar. He holds the Chartered Financial Analyst (CFA) designation and is a veteran of the Marine Corps. Let's Talk Money! with Joseph Hogue, CFA

Subscribe to:

Post Comments (Atom)

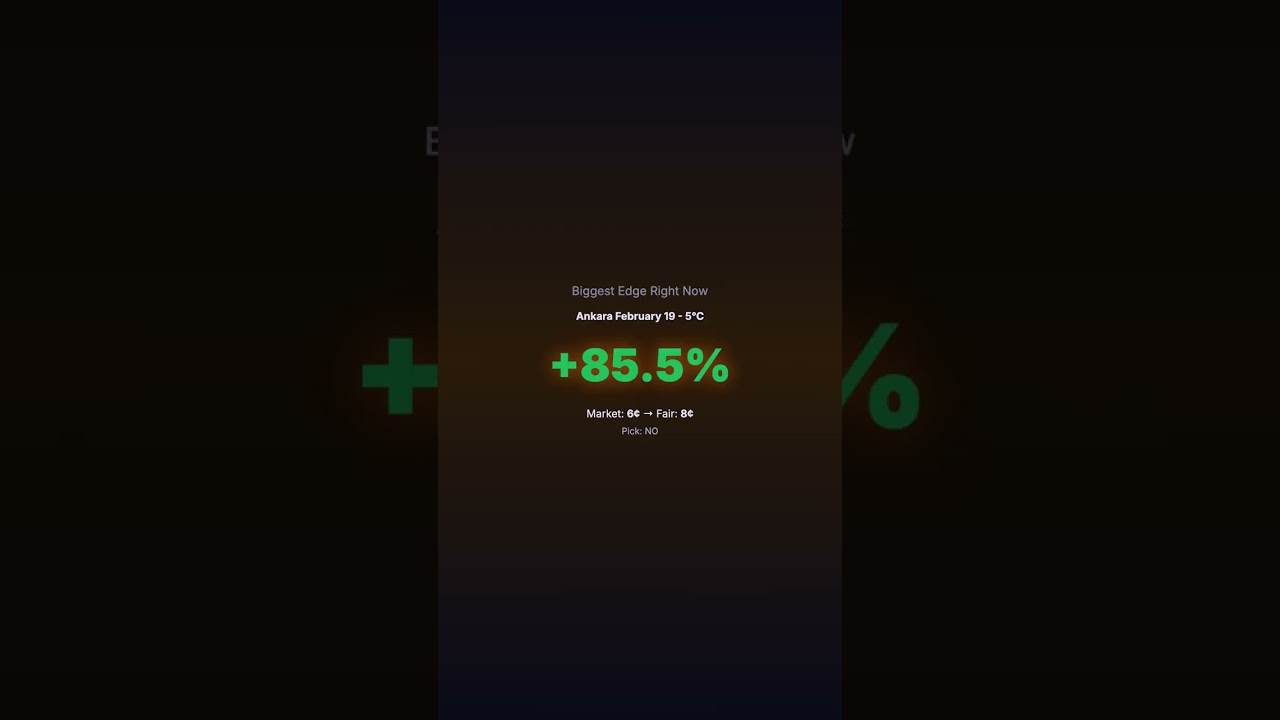

This Market Was 85% Off. Nobody Cared.

This Market Was 85% Off. Nobody Cared. https://www.youtube.com/watch?v=fnjIEYYCgVk A 85 percent edge. Sitting there for hours. Ankara Febru...

-

Top Dividend Stocks to Beat the Market [2x Stock Returns 2019] https://youtu.be/hPFm1sR7ihY These top dividend stocks are nearly doubling t...

-

**WTF Seriously, what is going on here ?? https://youtu.be/EMBJWXOgJhA Leave a Like if you enjoyed! For more financial planning info ➤ http...

-

Earn $200 in 10 Minutes for FREE (Work at Home) https://youtu.be/RCjySySVf0Y My #1 Recommendation to Earn Money Online CLICK HERE ➡️ https:...

No comments:

Post a Comment