The Value Investing Trap [3 Stocks to Buy and 3 to Avoid] https://youtu.be/Wb1bZZsod5Y I love value stocks but there’s a big difference between value investing and a value trap. I’ll show you how to tell the difference and reveal three value stocks to buy right now. Don’t forget, get two FREE stocks and a chance to get a third free share worth up to $300 on Webull with this link . Great features for investing and a stock simulator to test your strategies. 🤑 https://ift.tt/2M1qRd4 I see it daily. People asking if they should jump in on the latest value stock only to come back a few days later asking if they should sell at a loss. The 2020 stock market is one of the biggest value investing traps I’ve ever seen! That doesn’t mean value investing is dead or you shouldn’t look for these stocks, but you do need to know what to look for and how to avoid the traps. In this video, I’ll start by explaining why value investing is such a trap right now and show you how to find the real value stocks. I’ll then reveal a few examples of value traps you must avoid. Investors are jumping all over the value traps. I’m talking all the stocks like JC Penney, Carnival Cruise Lines and United Airlines. Sure some of these stocks may rebound but there will be many more that will crash and burn, taking all your money with them. That isn’t value investing, it’s throwing darts at the stock market. Instead you need to know how to find the real value stocks in this market, even if they don’t look like value stocks. That means understanding, what is a value stock, in the first place. A value stock is one that trades for a low price relative to its earnings, a low price-to-earnings ratio. It doesn’t matter if the stock price has crashed if the earnings have crashed even further or if the company is at risk of bankruptcy. To find the real value stocks then, you need to be able to find the ones with earnings surging higher and a stock market that doesn’t see it yet. I’ll show you how to do that and reveal three of my favorite value stocks to buy right now. 0:27 Why value investing is a trap right now 3:12 What are value stocks? 4:10 How to find real value stocks in this market 8:15 Worst value stock traps right now Join the conversation in our private Facebook Group! https://ift.tt/2SL3NCQ Join the Let's Talk Money community on Instagram! https://ift.tt/336QCQl My Investing Recommendations 📈 📊 Download this Portfolio Tracker and Investing Spreadsheet! [Community Discount Code] https://ift.tt/2IaUgA4 Free Webinar – Discover how to create a personal investing plan and beat your goals in less than an hour! I’m revealing the Goals-Based Investing Strategy I developed working private wealth management in this free webinar. Reserve your spot now! https://ift.tt/2TbmwcK SUBSCRIBE to create the financial future you deserve with videos on beating debt, making more money and making your money work for you. https://ift.tt/2zsdiOe Joseph Hogue, CFA spent nearly a decade as an investment analyst for institutional firms and banks. He now helps people understand their financial lives through debt payoff strategies, investing and ways to save more money. He has appeared on Bloomberg and on sites like CNBC and Morningstar. He holds the Chartered Financial Analyst (CFA) designation and is a veteran of the Marine Corps. #stockstowatch #stockmarket #stocks Let's Talk Money! with Joseph Hogue, CFA

Subscribe to:

Post Comments (Atom)

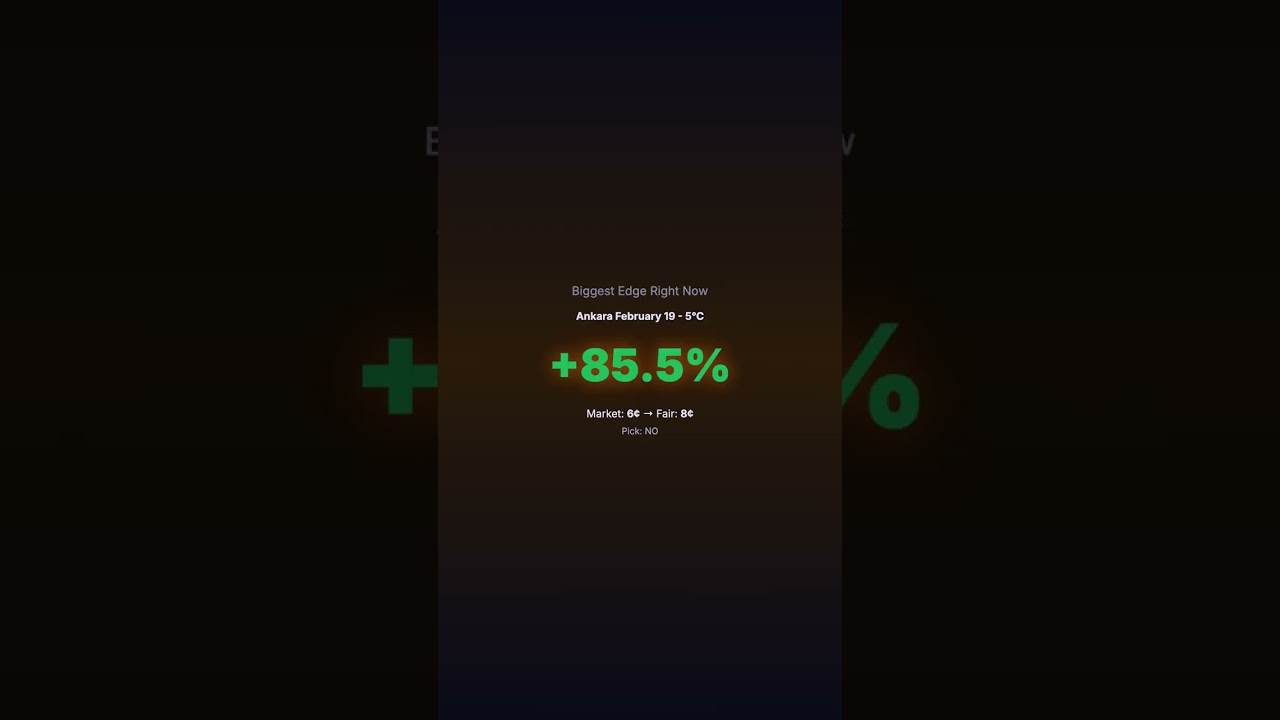

This Market Was 85% Off. Nobody Cared.

This Market Was 85% Off. Nobody Cared. https://www.youtube.com/watch?v=fnjIEYYCgVk A 85 percent edge. Sitting there for hours. Ankara Febru...

-

Top Dividend Stocks to Beat the Market [2x Stock Returns 2019] https://youtu.be/hPFm1sR7ihY These top dividend stocks are nearly doubling t...

-

**WTF Seriously, what is going on here ?? https://youtu.be/EMBJWXOgJhA Leave a Like if you enjoyed! For more financial planning info ➤ http...

-

Earn $200 in 10 Minutes for FREE (Work at Home) https://youtu.be/RCjySySVf0Y My #1 Recommendation to Earn Money Online CLICK HERE ➡️ https:...

No comments:

Post a Comment