How a Reverse Stock Split Destroys Wealth [Real Research] https://youtu.be/-bKC3T20pa8 Are reverse stock splits good or bad and what does the research say? I’m breaking down everything you need to know about reverse splits so you don’t lose money. We’re seeing an explosion in announced reverse stock splits lately, especially with oil stocks like Chesapeake and funds like the USO and UCO. What are these financial tricks and is it just a scam to make the stock look better? Check out the stock simulator and Get 2 FREE shares of stock worth up to $1000 each when you open a Webull investing account with a $100 deposit! 🤑 https://ift.tt/2M1qRd4 I’ll start by explaining what a reverse stock split really is and what happens when shares split. I’ll show you a real-world example using the USO reverse stock split and what it means for your investment. I’ll also show you research into 1,600 reverse stock splits and why it could be bad news for your stock. You see, at its core, nothing really happens in a reverse stock split. It’s still the same company and same stock. There are just fewer shares. You have the same amount of money invested, you didn’t lose shares, it’s just spread over a fewer amount. The most common forms are a 1-for-3 and a 1-for-8 split which means three- or eight-shares merge into one. That’s really the most confusing part, it’s not really a reverse stock SPLIT, it’s a stock consolidation. I know it can seem confusing at first so we’ll spend plenty of time with a reverse split example and calculation. Then I’ll reveal the true reasons companies do reverse stock splits so you don’t believe the lies. I’ll explain why that research into reverse splits might be wrong and why you might not want to sell your shares before a reverse split. There are good examples of reverse splits where the shares were worth more after the split like AT&T and Citigroup. Usually the shares are a little weaker after the split, after all nothing really changed with the company, but it gives management time to turn around the finances. Of course, this isn’t what happens with most reverse splits so you need to analyze the shares and ask yourself if management can turn it around. 0:57 What is a Reverse Stock Split? 1:17 What Happens when a Stock Reverse Splits? 2:10 Reverse Stock Split Example: USO Reverse Stock Split 2:52 Do You Lose Shares in a Reverse Split? 3:48 Why do Companies Do Reverse Stock Splits? 5:10 What Happens after a Reverse Stock Split? 6:17 Should I Sell My Stock Before a Reverse Split? 7:07 What is a Stock Split? Join the conversation in our private Facebook Group! https://ift.tt/2SL3NCQ Join the Let's Talk Money community on Instagram! https://ift.tt/336QCQl My Investing Recommendations 📈 📊 Download this Portfolio Tracker and Investing Spreadsheet! [Community Discount Code] https://ift.tt/2IaUgA4 Free Webinar – Discover how to create a personal investing plan and beat your goals in less than an hour! I’m revealing the Goals-Based Investing Strategy I developed working private wealth management in this free webinar. Reserve your spot now! https://ift.tt/2TbmwcK SUBSCRIBE to create the financial future you deserve with videos on beating debt, making more money and making your money work for you. https://ift.tt/2zsdiOe Joseph Hogue, CFA spent nearly a decade as an investment analyst for institutional firms and banks. He now helps people understand their financial lives through debt payoff strategies, investing and ways to save more money. He has appeared on Bloomberg and on sites like CNBC and Morningstar. He holds the Chartered Financial Analyst (CFA) designation and is a veteran of the Marine Corps. #reversesplit #stocksplit #stocks Let's Talk Money! with Joseph Hogue, CFA

Subscribe to:

Post Comments (Atom)

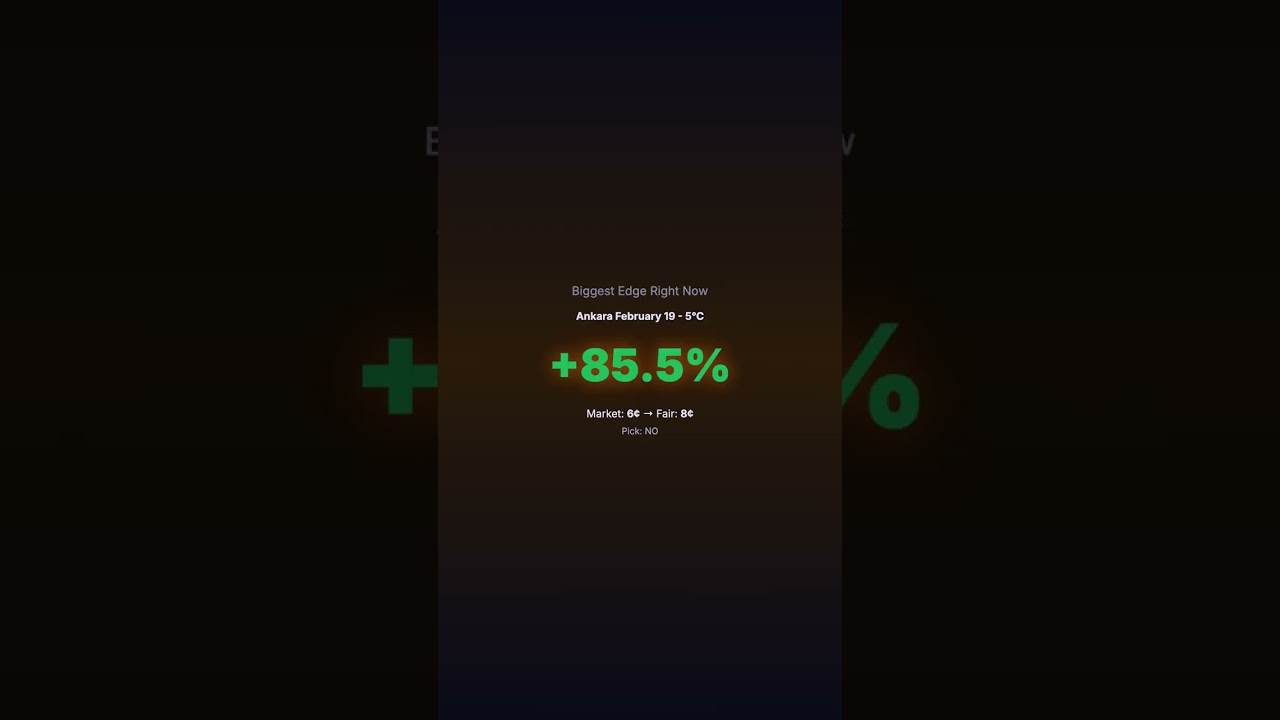

This Market Was 85% Off. Nobody Cared.

This Market Was 85% Off. Nobody Cared. https://www.youtube.com/watch?v=fnjIEYYCgVk A 85 percent edge. Sitting there for hours. Ankara Febru...

-

Top Dividend Stocks to Beat the Market [2x Stock Returns 2019] https://youtu.be/hPFm1sR7ihY These top dividend stocks are nearly doubling t...

-

**WTF Seriously, what is going on here ?? https://youtu.be/EMBJWXOgJhA Leave a Like if you enjoyed! For more financial planning info ➤ http...

-

Earn $200 in 10 Minutes for FREE (Work at Home) https://youtu.be/RCjySySVf0Y My #1 Recommendation to Earn Money Online CLICK HERE ➡️ https:...

No comments:

Post a Comment